The latest 2023 APAC hospitality statistics, including exclusive TrustYou and third-party data [updated quarterly].

TrustYou APAC Hospitality Statistics Q3 2023

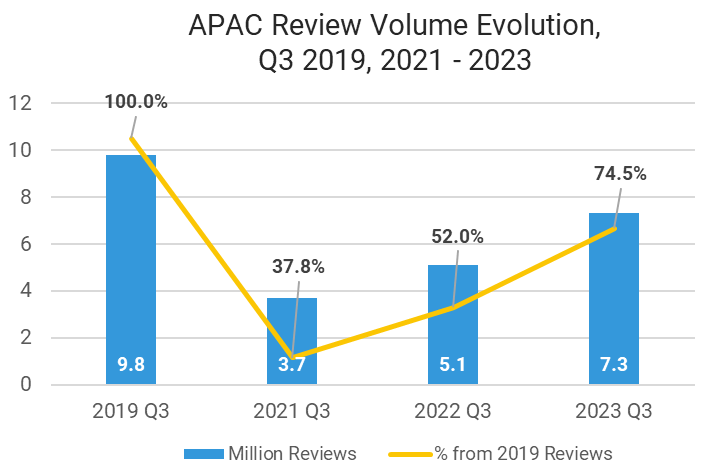

#1 Review Volume Continues to Register an Accelerated Growth

Q3 2023 APAC review volume reached 74.5% of the pre-pandemic level and recorded a 43.1% increase compared to Q3 2022.

There aren’t any significant shifts in the review volume evolution (1.4% increase) compared to Q2 2023.

However, 2023 is a breakthrough year for APAC. It started in Q1 2023, when as a result of relaxing COVID-19 restrictions, travel resumed. The first two quarters registered the highest increases in review volume, but Q3 2023 also shows an impressive recovery, although at a more moderate level.

#2 Even More Positive Reviews in Q3 2023

95% of APAC guest reviews are positive.

The number of positive reviews registers an upward evolution for the APAC region since Q1 2023, showing the commitment of hoteliers to delivering an exceptional guest experience.

responseAI Goes Unlimited

Responding to feedback is easier than ever with responseAI. And now TrustYou is proud to offer unlimited credits* to respond to all of your reviews. This allows hoteliers to engage with guests on a larger scale, providing a more comprehensive and personalized experience.

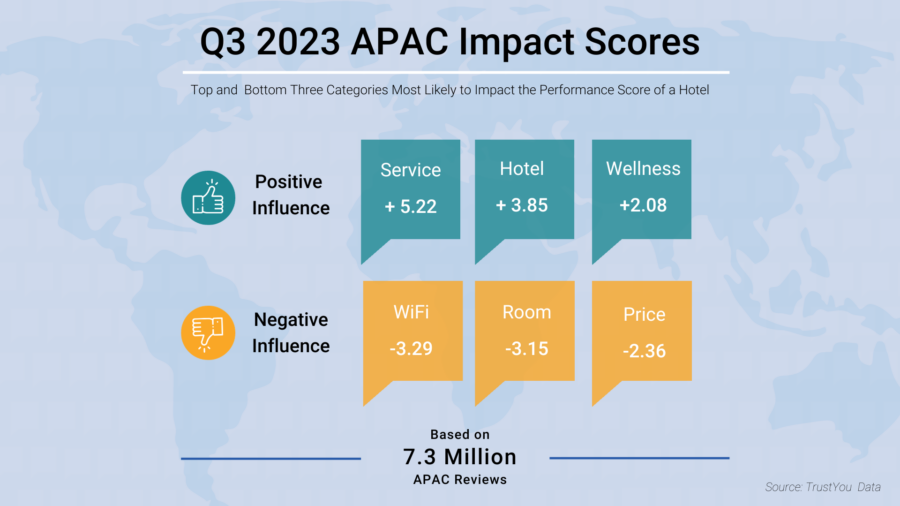

#3 Service and WiFi Continue to Shape Most Performance

The top and bottom categories impacting the performance of a hotel have remained unchanged compared to Q2 2023. WiFi solidifies its position as an area dragging the performance down. In 2022 and the first quarter of 2023, Room was the category most likely to bring negative scores, highlighting the focus on cleanliness during a more restrictive period. APAC is the only region where Room is still the second factor in our bottom impacts, with Price being only third.

Some new subcategories have emerged as drivers of guest satisfaction. Golf Hotels brought more positive reviews this quarter than before. On the other side, Maintenance is among the subcategories most likely to make guests give lower ratings.

Industry Wrap-Up – APAC Hospitality Statistics Q3 2023

#4 Latest Booking Behaviors of Asian Travelers Unveiled

In one of their latest reports, Hospitality Planet looks at key preferences of today’s travelers from pre- to post-stay. Here are a few findings that define the Asian travelers:

- Asian travelers are most likely to book a hotel via an OTA (68%), compared to the global average (62%).

- Almost half of Asian guests say they experience issues paying for reservations with their usual preferred method, compared to 29% globally.

- Asia is also among the regions with the highest proportion of guests preferring self-check-in via a personal device – 43%, compared to 32% globally.

#5 Chinese Summer Travel Fever Amid Ongoing Real-Estate Crisis

Travel is recovering in China, but at a slower pace than expected. The deepening real-estate crisis has affected the purchasing power of Chinese consumers, now more cautious with their budgets. It is estimated that Chinese spending abroad will only reach 30% of its pre-pandemic level this year. Experts anticipate that a full recovery in terms of international demand will be possible in the second half of 2024 at the earliest.

While international travel registers a slow progression, domestic travel is in a much better position. The number of car rental requests increased significantly between July and August, 50% year-over-year growth, surpassing 2019 numbers. For rentals for more than 5 days, the requests increased by 70% year over year. In July, China Railway reported 14.2% more passenger trains than in 2019. Some museums decided to extend their opening times due to an unprecedented demand.

#6 Japan Registering Good Performance, Despite Lower Demand from Chinese Travelers

According to the Japan National Tourism Organization (JNTO), the number of international visitors to Japan in September reached 2.18 million, slightly higher than in August and at 96.1% percent of the total number of foreign tourists in 2019. Demand from countries like the US, South Korea, and Singapore registered new records in September.

However, one of the main markets for Japan, China, is still below the pre-pandemic numbers, reaching only 40% of its 2019 levels. Previously, Chinese tourists comprised nearly one-third of all tourists and accounted for 40% of all tourist spending in Japan. Although the ban on group travel has been lifted, strained relations between Japan and China continue to impact tourism.

TrustYou APAC Hospitality Statistics Q2 2023

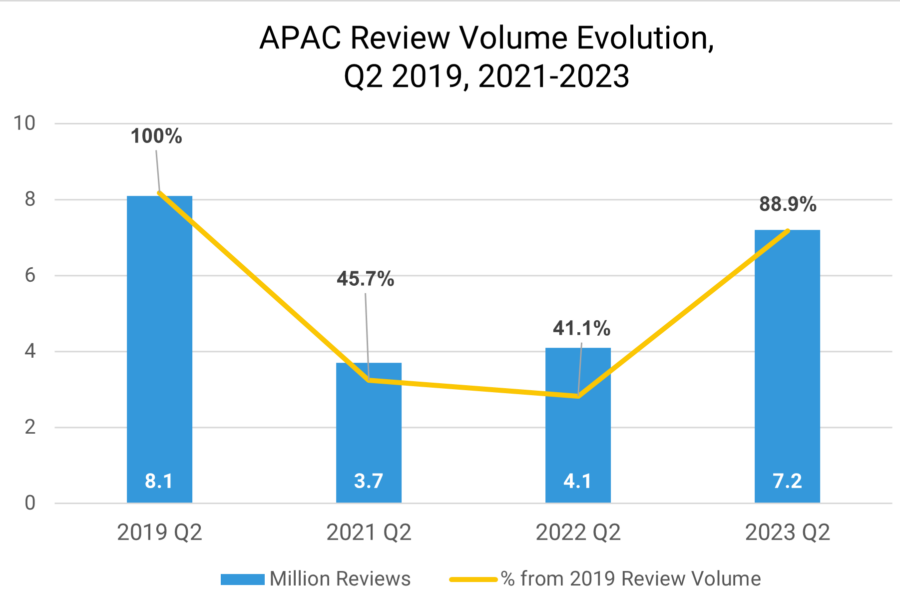

#1 An Accelerated Increase in Review Volume

There’s no stopping travel rebound in APAC. Now that China’s borders are open, the region is quickly recovering, getting very close to pre-pandemic numbers and soon outpacing the current leader of rebound, EMEA.

Q2 2023 APAC review volume reached 88.9% of the pre-pandemic level and recorded a 74.3% increase compared to Q2 2022.

#2 APAC Received More Positive Reviews in Q2 2023

94% of APAC guest reviews are positive

Not only have the number of reviews increased, but we also witnessed a slightly higher ratio of positive reviews. In Q1 2023, 93% of all feedback was positive.

Why You Need an AI Response Generator to Reply to Guest Reviews

Here’s how an AI response generator for your guest reviews will help you save time & money while improving the guest experience.

#3 Service Improves Scores; WiFi Brings Lower Ratings

The Q2 2023 APAC positive impacts follow similar patterns as in Q1 2023 and 2022. Wellness services continue to be a specific factor in the region that also brought higher scores in 2022.

We see some shifts in the negative impacts. For the first time, WiFi comes first in the negative impacts, overthrowing Room to second place. Historically, Room was primarily known for its negative impact on performance because of cleanliness-associated categories like bathroom cleanliness and maintenance. Getting closer to a positive impact can be attributed to reopening the entire region and COVID-19 being treated as an ongoing health issue rather than a public health emergency.

In Q2 2023, guests valued interacting with amiable staff and supportive management as the most essential aspect of their service experience. Travelers particularly appreciated Economy and Water Park Hotels. Wellness services, such as spas or access to hot springs, with dedicated, supportive staff, were more likely to bring higher scores.

For negative impacts, guests often complained about a poor WiFi connection or costs associated with internet access. Bathroom amenities and cleanliness for the category Room would most likely bring lower scores. APAC guests weighted the value for money during a stay and paid particular attention to food prices.

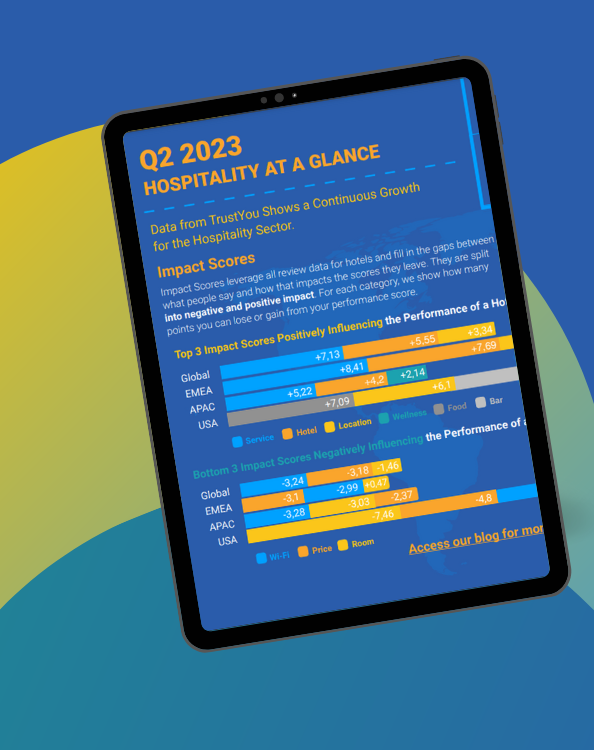

Q2 2023 Hospitality at a Glance

All you need to know about how hospitality evolution – in one page. Access our exclusive infographic summarizing global and regional review volume, categories impacting performance, and review sources.

Industry Wrap-Up – APAC Hospitality Statistics Q2 2023

#4 Special Forces Travel: New Trend in China as Travelers Spend Cautiously

Labour Day brought a surge in domestic travel in China. Between April 28th to May 3rd, more than 274 million trips were made, 19% more than in 2019. However, travel spending has been almost on par with 2019, registering a 0.7% increase.

Undeniably, Chinese travelers are looking forward to hitting the road. Compared to 2019, they seem to be more cautious when planning their budgets for vacations. Budget awareness has become a trend, especially among young travelers. #specialforcestravel has taken Chinese social media by storm. This trend is all about traveling and seeing as many places as possible

on a tight budget. In an interview with Routers, many “special forces” adopters share their sacrifices to discover new places, including cheap accommodations or low-cost transportation.

#specialforcestravel is a sign of a still recovering economy, currently hit by a housing crisis and all-time high unemployment rates among the younger generations. This affects internal tourism spending and also indicates a slower recovery for outbound travel. Labour Day data show the difference between domestic and outbound travel volume. In this period, international flights reached only 40% of 2019. Another reason for a slower comeback to the international scene is the significantly lower number of flights. For example, at the end of April, there were 94% fewer flights to and from the US.

#5 The Good Tourist Guide – Etiquette for Visiting Bali

To preserve the unique culture of Bali and to prevent any behavior that may be considered unruly, authorities have created a set of guidelines for tourists visiting the island. The information will be included in a flyer distributed upon arrival at the Ngurah Rai airport. It will consist of basic rules when visiting temples, mountains, or banyan trees.

Since reopening, Bali has seen a surge in the number of tourists and an increase in deportations due to unruly behavior. Posting nude or semi-nude pictures next to sacred places or using a tourist visa to work instead are among the reasons you can get kicked off of the island.

The government is also considering banning scooters for visitors due to increased accidents and many tourists renting them without a driver’s license. The introduction of a tourist tax is also discussed. The collected money will be used for preserving nature and tourist landmarks.

#6 APAC Countries Snapshot

At the beginning of Q2, Chiang Mai, the third biggest city in Thailand, experienced high air pollution levels. Residents were advised to avoid outdoor activities or wear masks to filter the harmful particles. Forest and crop fires from Thailand and neighboring countries have been causing this issue. In 2019, the city received more than 10.8 million visitors. As a result of this alarming rise in pollution, hotel occupancy dropped to 45%. Affecting the life of more than 1.3 million people, air pollution in Thailand also poses a threat to the future of tourism. While the government is looking for solutions to decrease this problem’s effects, including reinforcing the Euro 5 emission standard, tourists are advised to visit the country during summer. From January to April, northern parts are especially to be avoided. This is the period when farmers burn their sugarcane fields.

Travel searches from India grew by 225 % in 2023 (January to May) compared to 2019. Searches for Vietnam grew by 390%, placing it among the top 5 destinations for Indians. While all eyes are on China’s comeback to the travel scene, India may become the new rising star of APAC. The spending power is growing – data from 2022 suggests that the Indian traveler spent 30% more on accommodation compared to 2019. This is 20% more than the Chinese traveler.

In May 2023, Japan registered 70% of the 2019 foreign visits. The demand was exceptionally high from Singapore, the US, and Canadian tourists – exceeding 2019 levels. With Chinese tourists still cautiously planning their outbound trips, South Korean travelers remain the no.1 source for Japanese tourism. At the end of April, Japan lifted the COVID-19 border controls.

TrustYou APAC Hospitality Statistics Q1 2023

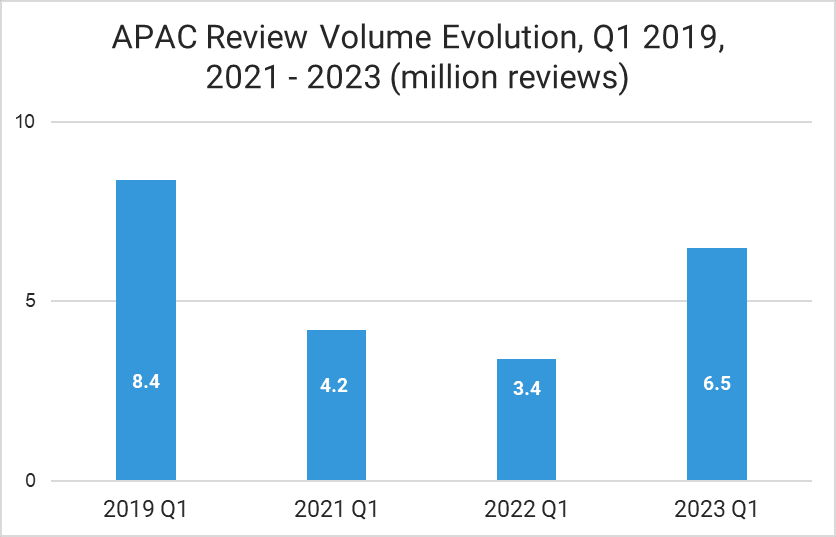

#1 Review Volume Increases Significantly

Q1 2023 APAC review volume reached 77.4% of the pre-pandemic level and recorded a 91.2% increase compared to Q1 2022.

In Q1 2022, the review volume was 41.1% of the total 2019 reviews. The review volume could surpass pre-pandemic numbers by the end of 2023 at this accelerated pace.

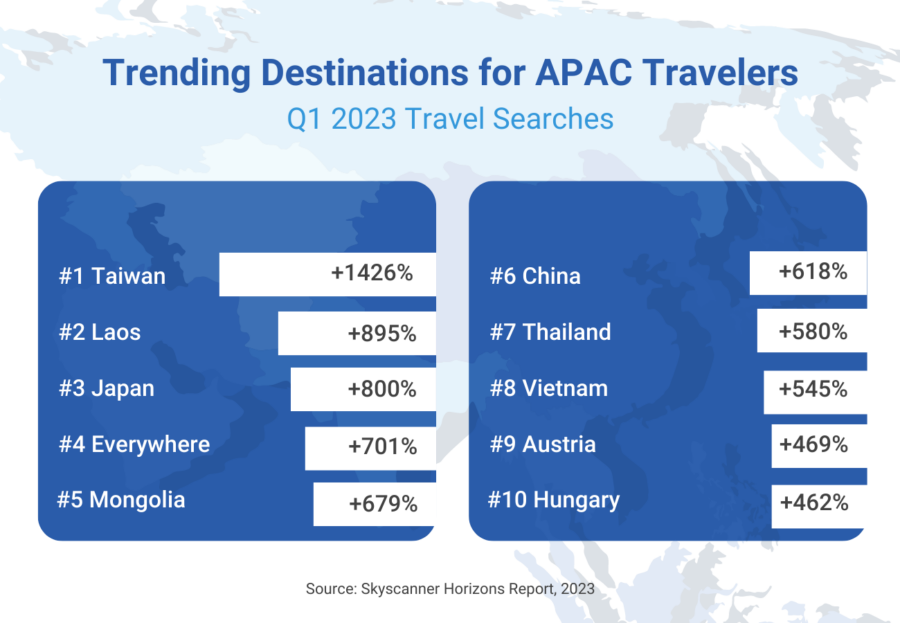

A growing appetite for travel confirms this accelerated growth. Skyscanner’s report shows a 701% increase for Q1 2023 in year-over-year global searches from APAC travelers, the highest growth recorded globally.

#2 Positive Feedback is Steadily High

93% of APAC guest reviews are positive.

Same as in 2022, this number proves that APAC hoteliers are committed to offering excellent service and listening to their guests’ needs.

Your Guide to Replying to Positive Reviews

When dealing with so many positive reviews, responding to them is crucial to increase guest satisfaction and return rate. You may turn a one-time satisfied customer into a returning, delighted guest by saying a genuine thank you. Check out our guide on how best to reply to your guests’ praises.

#3 Service Improves Scores; Room Brings Lower Ratings

APAC Impact Scores follow similar patterns to the 2022 categories and subcategories.

Wellness services are a specific factor in the region that also brought higher scores in 2022. APAC and the US are the only regions where Room is the first in the top negative categories. With relaxation measures being implemented throughout 2022, cleanliness remains a top priority, reflected in the category Room.

For Service, what mattered most for guests in Q1 2023 was interacting with friendly staff and helpful management. Travelers particularly appreciated WaterPark and WinterPark Hotels. As for wellness services, hotels were more likely to receive higher scores if they had specific services such as spas or access to hot springs and if the designated staff was helpful.

Room maintenance and bathroom were most likely to bring lower scores for the category Room. A slow and unstable internet connection was also crucial in decreasing scores. APAC guests weighted the value for money during a stay, and if it didn’t correspond to their expectations, they were more likely to leave lower evaluations. Another crucial factor in the category Price was food prices.

Industry Wrap-Up – APAC Hospitality Statistics Q1 2023

#4 Top Q1 2023 Destinations

The recent report by Skyscanner looks at search patterns from Q1 2023. APAC travelers still want to explore their region first – 7 out of 10 destinations included in the list are from APAC.

#5 Spotlight on China: Domestic Travel on the Rise

The lift of the Zero-COVID policy at the end of 2022 brought China’s first signs of travel recovery. According to the Chinese Ministry of Culture and Tourism, domestic trips increased by 46.5% in Q1 2023 compared to last year.

A complete return of Chinese travelers to the international scene will likely happen gradually. Economic pressure, fueled by the housing crisis and COVID-19, is among the main reasons Chinese consumers do not travel abroad. As a result of prolonged lockdowns, traveling behaviors also changed. Chinese consumers prefer to schedule their trips at shorter notice, worried about possible disruptions related to the pandemic. Health & safety is a primary concern. Therefore, tourists are more likely to travel in smaller groups and choose sustainable options.

The desire to travel internationally will increase gradually this year, with the younger generations expected to break the traveling pattern sooner. Dragon Tail’s survey confirms that the overall demand will rise starting in July, with 42% of those surveyed planning to travel between July-August and 32% planning their trips for the Mid-Autumn Festival / National Day at the end of September to the beginning of October.

While consumers’ sentiment towards international destinations may quickly change this year, the Chinese authorities are dealing with other restraints that may slow down outbound travel. After three years of standstill, the airline industry is not prepared to fully return to pre-pandemic levels and ensure the necessary seat capacity. In the first months of 2023, a limited number of flight destinations were available at very high rates, and this is expected to continue throughout the summer.

All these factors point to a gradual comeback of China on the international travel scene. An analysis by Oxford Economics points out that China’s outbound travel could reach 48% of 2019 levels. As with the other countries and regions reopening their borders after the pandemic, a full recovery will most likely be possible over a more extended period.

#6 APAC Snapshot

South Korea registered a year-over-year increase of 51% in hotel bookings from March 15th – June 30th. Arrivals from Europe (UK, France, Italy, Spain, and Germany) registered a 456% growth year-over-year.

New visa rules are slowing the recovery process in Vietnam. Since the country reopened, travelers must apply for a visa in advance. The visa-on-arrival procedure applies now only for visitors traveling on tour with a local operator. The new rule caught a lot of travelers by surprise. Unclear communication from Vietnamese authorities lead to a considerable number of rush applications. In 2022, international arrivals to Vietnam recorded an 80% decrease compared to 2019. Neighboring countries registered a better performance. Thailand had 72% fewer visitors, and Cambodia had a 65% decrease compared to pre-pandemic levels.

India started strong this year. February international arrivals recorded a 254% increase compared to 2022 and only 20% behind 2019.

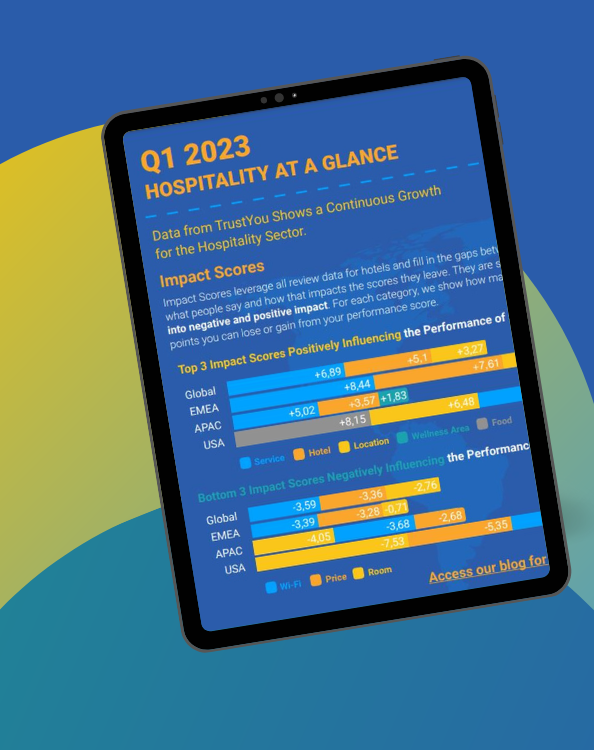

Q1 2023 Hospitality at a Glance

All you need to know about how hospitality evolution – in one page. Access our exclusive infographic summarizing global and regional review volume, categories impacting performance, and review sources.

Thailand exceeded its Q1 2023 arrival target. The country welcomed 6.15 million tourists between January – March 2023. The authorities initially set a target of 6 million tourists. Overall, Thailand expects between 25-30 million international visitors this year.

More than 2.9 million travelers visited Singapore in Q1 2023, which equals 62% of 2019 levels. The length of visit extended slightly compared to pre-pandemic levels. The Singaporean authorities are working on a comprehensive strategy to strengthen the tourism sector. Among key areas, the destination seeks more visibility through entertainment content. To confirm its top position as a MICE destination, the Singapore Tourism Board is working with various global tourism organizations to define the first sustainability guidelines for the MICE and attractions sectors.

Use Guest Reviews to Attract More Happy Travelers

Happy travelers spend more, book again, and promote your brand. How do you increase your visitors’ satisfaction as a hotel, destination, or booking platform?

TrustYou offers a powerful tool for the hospitality industry that helps attract more visitors and improve guest satisfaction. With the help of our all-in-one reputation management platform, you can collect and analyze feedback from guests, identify improvement areas and address issues promptly. This leads to increased guest satisfaction, positive reviews, and, ultimately, more bookings. Our guest experience solution platform allows you to engage with guests before, during, and after their stay, fostering a sense of connection and building trust.

Get Your Demo with TrustYou

See an overview of the world’s leading all-in-one platform, including reputation management, review marketing, and guest surveys. You’ll see firsthand how to make better business decisions for your organization, earn trust, and succeed.

*The requested Q1 2023 top and bottom Impact Scores reflect the main semantic categories.

** Q1 2023 Impact Scores and Review Volume were requested at the beginning of April 2023. Due to the dynamic nature of the database with reviews and hotels being updated, the numbers may vary if data were requested at an earlier or later stage.

***the report includes rounded numbers for a clearer data representation.